Community Development Financial Institutions have emerged as the “ultimate impact investment,” able to effectively tackle some of our most pressing challenges: the affordable housing crisis; the climate emergency; and persistent racial health, wealth, and opportunity gaps.

That’s according to CDFIs and the Capital Markets: Trends in Investment & Impact Measurement, the third white paper in a series from Local Initiatives Support Corporation (LISC) and the first in collaboration with Enterprise Community Partners.

But how have CDFIs fared in a year characterized by rising interest rates and market volatility?

We recently spoke with Anna Smukowski, one of the paper’s co-authors and senior director of capital programs for the Enterprise Community Loan Fund, to find out.

“The COVID-19 pandemic and the racial reckoning of 2020 really brought a lot of attention to how we can put capital to work, and CDFIs are really well suited to play that intermediary role. We’re seeing that translate into growth now,” Smukowski said.

To learn more about the state of the CDFI capital market landscape, we asked Smukowski to share five trends and takeaways from the white paper.

When you're telling someone that you're investing in affordable housing or in small businesses, that's tangible. CDFIs are a way for people to directly see how their dollars can make an impact in the places they live and work.

1. Rated CDFI transactions grew by more than 30%, underlining continued interest from capital markets.

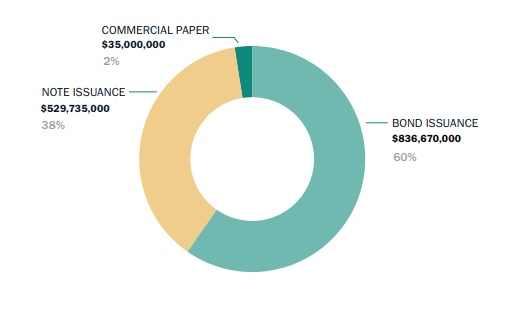

In the 2020 report, 11 CDFIs had been rated by Standard & Poors, with nine accessing the capital markets. Across the spectrum of rated bond offerings and note programs, offerings totaled $1.05 billion.

By the end of 2022, that total was up to around $1.40 billion—a 33% uptick from the last report—and now includes a commercial paper program in addition to rated bond offerings and note programs. The number of S&P-rated CDFIs also increased to 13, while a second rating agency—Fitch Ratings—entered the market and added two more.

“We’re building a strong asset class,” Smukowski said. “For CDFIs looking to diversify their capital sources, a bond can provide the opportunity to go out and raise a bunch of capital at once.”

While bond-rated CDFIs remain a relatively small part of the overall capital markets, their continued growth showcases an ability to provide financing comparable to other, more mainstream capital market transactions.

“Ratings provide additional information and comfort to an investor,” Smukowski explained. “A third party looking at the financial strength of a CDFI creates assurance that the CDFI will be able to maintain their overall asset quality and repay investors on time. It also offers comparison and standardization across CDFIs.”

2. More money is flowing into rated impact note programs issued from CDFIs.

Rated bonds are just one piece of the overall toolkit CDFIs can use to provide competitive capital. Impact note programs, which offer a more accessible route into the industry for retail investors, continue to grow in popularity.

As of year-end 2022, $530 million had been raised across three separate rated note programs. That amounts to greater diversity in maturities offered—and more opportunities for retail investors.

“For both rated bond and note programs, you have an issuer credit rating, but then the underlying debt instrument is rated, too,” said Smukowski. “That provides additional security to an investor looking at the quality and stability of a fixed income security.”

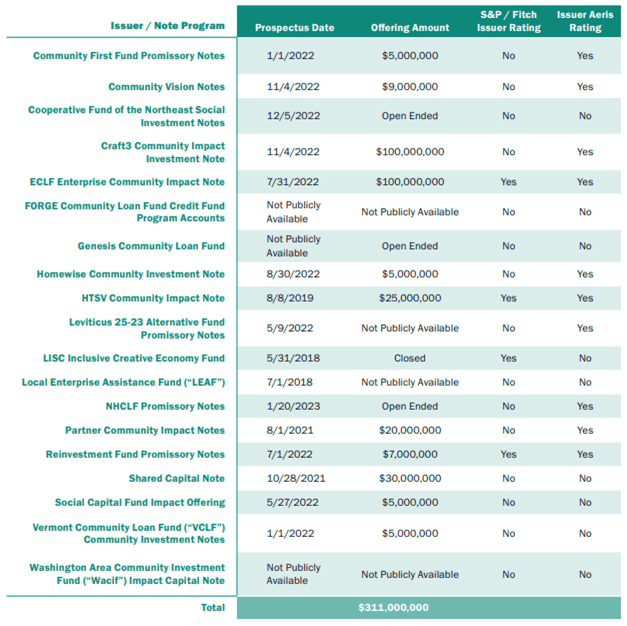

3. Investor appetite remains strong for unrated impact note programs—which enables CDFIs to continue providing low-cost financing for critical community development efforts.

CDFIs can also leverage unrated note programs, which continue to be a popular capital raising tool. Based on publicly disclosed information, 19 unrated note programs are currently offered across the market, totaling $311 million.

“There's enough diversity across impact note programs that anyone can find what they're looking for,” Smukowski said. “For an issuer, unrated note programs can serve as attractive vehicles to raise low-cost capital in an increasing interest rate environment.”

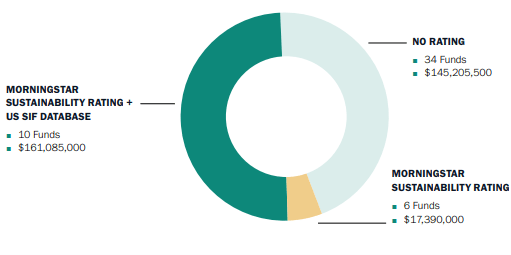

4. A growing number of bond funds—and investors—are committed to sustainability.

Research for the white paper partially focused on impact goals. “We wanted to see if CDFIs were being picked up by bond funds with a commitment to sustainability and impact,” Smukowski said.

They found that, as of July 2022, about $162 million of rated CDFI debt comes from investors dedicated to sustainability.

“There’s interest in CDFIs from bond funds, both from an impact lens and a financial lens, which I think is exciting,” Smukowski added.

5. CDFIs remain at the forefront of transparency and measurability.

Six of the 10 bond offerings were aligned with the International Capital Market Association (ICMA) Sustainability Bond Guidelines upon issuance, with four receiving a second party opinion. Meanwhile, two of the three rated note programs align with Sustainability Bond Guidelines.

So what does that mean for investors?

“The CDFI industry continues to align with existing and emerging frameworks on impact disclosure and reporting,” Smukowski said. “I think that’s an easy way for new investors to understand the type of impact that we make. We’re trying to communicate the work we do supporting communities in a way that’s comparable to other CDFIs and across asset classes.”

Dig deeper into these trends and more with CDFIs and the Capital Markets: Trends in Investment & Impact Measurement. To learn more about investing in a CDFI, visit the Enterprise Community Loan Fund.