SACRAMENTO, Calif. (April 15, 2024) – Today, Enterprise Community Partners (Enterprise) released the California Affordable Housing Pipeline 2024 report outlining the resources and policies needed to tackle the urgent and growing need for 1 million affordable homes in the state. The report reveals the status of affordable homes in the near-construction pipeline and highlights four key actions that can scale development and combat delays preventing the production of affordable housing options across the state.

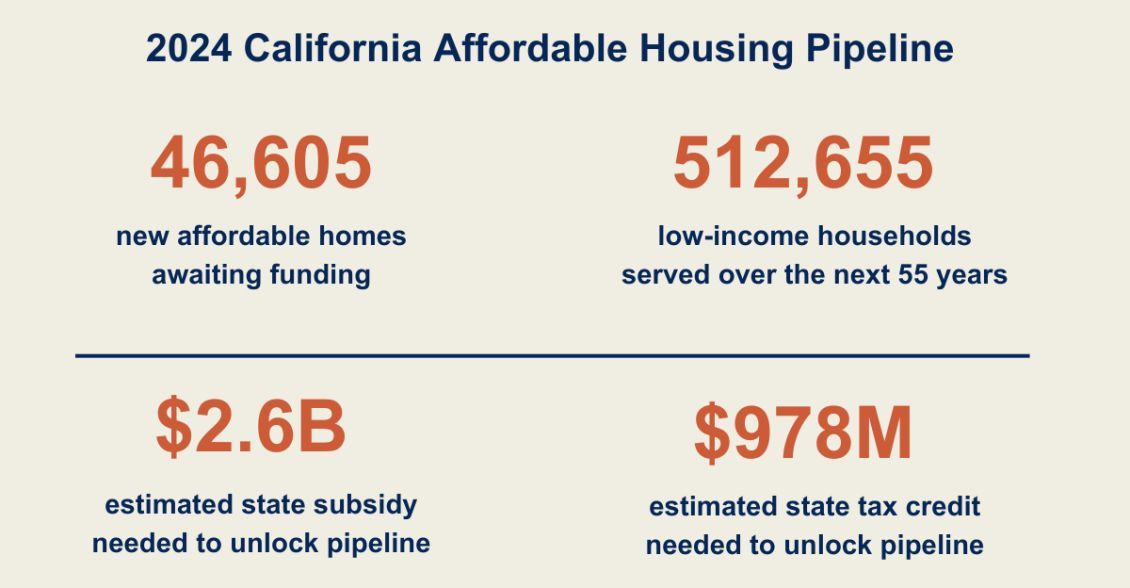

Enterprise’s research found that 46,605 new affordable homes are in the near-construction pipeline, but these developments have not broken ground due to a lack of public funding. Many pipeline projects have secured local site control, entitlements, and local funding commitments. These affordable developments would benefit an estimated 512,655 households over the next 55 years.

“California is a stark illustration of the greater affordable housing crisis in the U.S. It’s absolutely critical that we address the funding needs to unlock this development pipeline and to advance solutions,” said Heather Hood, VP and Northern California Market Leader at Enterprise Community Partners. “Our research shows that there are significant numbers of homes ready and waiting to be built in California communities for families struggling to find a safe, stable, affordable home — if only funding were to be made available. The development of new affordable homes is a critical response to combat the housing crisis and rising homelessness, and we urge local, regional, state and federal leaders to prioritize resources to prevent further delays.”

The research found that to move the pipeline forward, these developments need an estimated $2.6 billion in state subsidies and $978 million in state tax credits. Modest state investments leverage significant federal and private dollars. On average, the state contributes $148,1200 in subsidies to each affordable home it funds. For every $1 of state funds invested in developments, $4 of private and federal funds are leveraged.

Enterprise’s report comes at a time when, according to the California Housing Partnership, California renters need to earn 2.8 times the state minimum wage to afford average rent, and Black renter households are 33% more severely cost-burdened than white renter households.

The report highlights four crucial opportunities to unlock the investments needed to support and scale the current California Housing Pipeline.

Invest in ongoing state funding

- Enterprise highlights maintaining funding in this year’s state budget for affordable housing programs as well as passing a state affordable housing bond, as proposed in Assembly Bill 1657 (Wicks), to support the current affordable housing pipeline.

- According to the California Housing Partnership, the bond would lead to the creation of 28,495 new homes for low-income families, 93,195 affordable homes preserved, rehabilitated or retrofitted, and 13,232 new homeownership opportunities for Californians.

- Enterprise concludes that a permanent and consistent source of investment for affordable housing is needed to meet the state’s needs.

Curb costs by addressing system inefficiencies

- Enterprise recommends that California can reduce development costs by better coordinating its housing finance system, including a single, unified funding application and a waitlist and off-ramp for federal resources. The current system requires developments to apply to multiple state housing finance agencies to access subsidies, bonds, and tax credits. This leads to many inefficiencies, adds additional costs and further delays the development of needed affordable homes.

Empower local and regional jurisdictions to do their part

- Enterprise sees a significant opportunity in Assembly Constitutional Amendment 1, which would amend the local bond measures threshold to 55% and effectively unlock opportunities to pass local affordable housing bonds.

Reform federal programs

- Enterprise recognizes the need for federal investments and reform to scale affordable housing solutions and emphasizes the opportunities available through the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024), which effectively expands the LIHTC.

- Enterprise estimates that if these reforms were enacted, it would lower the pipeline’s need for tax-exempt bonds from $8.2 billion to $4.9 billion. In practice, this would dramatically increase access to federal 4% LIHTC in California, which is available on an as-needed basis to qualifying developments with tax-exempt bonds.