Many of the programs that offer funding for efficient, climate-resilient affordable housing through the Inflation Reduction Act (IRA) have reached important turning points. Read on for the latest updates on available funding. Note upcoming application deadlines, strategize how to best leverage available tax credits, and mark your calendars to connect with upcoming funding opportunities.

HUD’s GRRP: Final Funding Rounds Open, Free Benchmarking Available

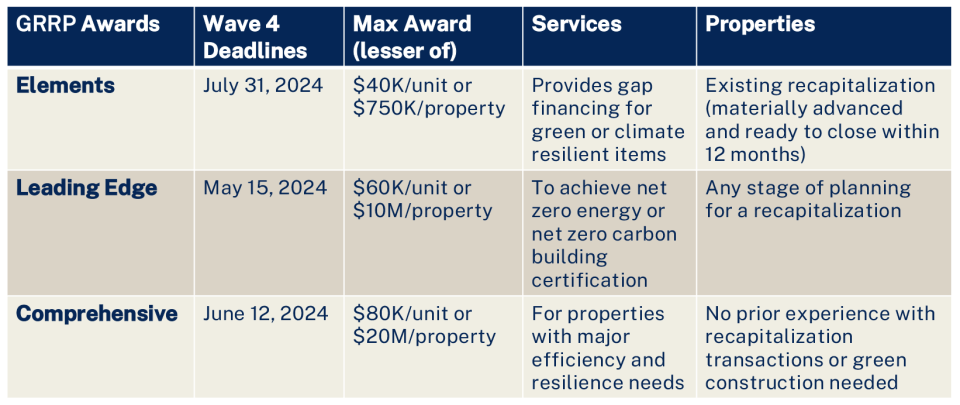

HUD’s Green and Resilient Retrofit Program (GRRP) provides funding for direct loans and grants for HUD assisted multifamily properties to fund projects that improve energy or water efficiency; implement building electrification, energy storage or zero-emission electric generation strategies; or address climate resilience. Nearly $840 million in grants and $4 billion in loans are available.

As part of the GRRP, HUD is now also offering free Energy and Water benchmarking services to properties receiving rental assistance from multifamily project-based programs. This new service provides participating multifamily property owners with data on energy and water consumption to aid in identifying opportunities to improve efficiency and assess rehabilitation efforts that may be eligible for grant or loan funding under the GRRP or other sources.

Low Income Communities Bonus Credit Applications Open Now

Interested in solar? In addition to expanding existing tax credits for renewable energy, the IRA added several provisions to increase funding for certain types of solar projects. The Investment Tax Credit (ITC) is a dollar-for-dollar credit for expenses invested in renewable energy properties, most often solar developments.

The Low-Income Communities Bonus Credit, Section 48(e), provides a 10-20% point boost to the ITC for qualified solar and wind energy facilities with a maximum net output of less than five megawatts. The IRA extended the ITC through 2032 as a 30% credit for qualified expenditures.

Applications are now open for the second round until June 27, 2024. The bonus credit offers either:

- A 10% boost for facilities installed in low-income communities or on Indian land

- A 20% boost for facilities that are part of a qualified low-income residential building or economic benefit project

DOE’s Office of Energy Justice and Equity administers the program in partnership with Treasury and the IRS. It aims to increase adoption of and access to renewable energy facilities in low-income and other communities with environmental justice concerns. DOE will review applications and make recommendations to the IRS to allocate up to 1.8 gigawatts of solar and wind capacity per year. Consult your tax professional to learn how this program can help you pay for renewable energy capacity to power your developments located in qualified areas.

Guidance Finalized Increasing Access to Clean Energy Tax Credits

The IRA has fundamentally transformed the way entities such as nonprofits and governments interact with tax credit funding. With two new credit delivery mechanisms – elective pay (“direct pay”) and transferability – state, local, and Tribal governments; nonprofit organizations; Puerto Rico and other U.S. territories, and other entities can now take advantage of clean energy tax credits. Treasury finalized elective pay rules in March, with final rules on transferability finalized in April.

Tax exempt and government entities can receive elective payments for several clean energy tax credits, including investment (Section 45), production (Section 48), electric vehicles and charging stations. Businesses can also choose elective pay for Sections 45X, 45Q and 45V. Businesses may transfer all or a portion of any of 11 clean energy credits to a third-party in exchange for tax-free immediate funds, enabling them to take advantage of tax incentives if they do not have sufficient tax liability to fully utilize the credits themselves.

With final rules available, we strongly encourage nonprofit owners/operators of affordable housing to evaluate what new proceeds may be available. Consult your tax professional to learn more about accessing these credits.

DOE Home Energy Rebates: Track your State’s Status, Plan Your Improvements

As of June 4, 2024, 17 states have submitted their applications for the DOE Home Energy Rebate Program. New York is the first state to have their application approved and launched its program May 30. DOE has published fact sheets and an online tracker that enables you to see your state’s status and to view announcements of public meetings about state program design.

As we’ve shared previously, DOE's Home Energy Rebate Program totals $8.8 billion in funding to be administered by states for two types of rebates:

- $4.3 billion for Home Efficiency Rebates – discounts on energy-saving retrofits in single- and multifamily buildings

- $4.5 billion for the Home Electrification and Appliance Rebates – rebates for high-efficiency electricity upgrades in homes

States are currently developing their programs and will receive their designated allotment once DOE approves their application. The deadline for states to submit is January 31, 2025.

EPA Now Accepting Grant Applications

Have a project in mind that builds capacity for communities to tackle environmental and climate justice challenges, strengthen their climate resilience, or advance clean energy? Applications are now open for EPA’s $2 billion Community Change Grants Program.

Eligible applicants are partnerships between two community-based organizations or a partnership between a CBO and a federally recognized Tribe, local government, or institution of higher education. EPA is accepting applications on a rolling basis until November 21, 2024. Technical assistance is available for eligible applicants to apply for and use this funding.

In addition, EPA selected regional grant makers to distribute funds for the Thriving Communities Grantmaking program. Beginning this fall, the competition for subgrants will open to community-based nonprofit organizations and other eligible organizations representing disadvantaged communities. The EPA has also designated Thriving Communities Technical Assistance Centers (TCTACs). There are 13 regional and three national technical assistance centers that are receiving at least $10 million to provide training and other assistance to build capacity for navigating federal grant application systems, developing strong grant proposals, and effectively managing grant funding. Find your regional TCTAC and take advantage of this resource.

EPA Announces $27 Billion GGRF Awardees

The EPA recently announced awardees of all three Greenhouse Gas Reduction Fund (GGRF) programs, the $14 billion National Clean Investment Fund (NCIF), $6 billion Clean Communities Investment Accelerator (CCIA), and $7 billion Solar for All program.

NCIF awardees will provide affordable financing for clean energy, zero emissions buildings and zero emissions transportation projects nationwide.

Among the three NCIF awardees is Power Forward Communities. Led by Enterprise, Rewiring America, Habitat for Humanity International, the Local Initiatives Support Corporation (LISC), and United Way Worldwide, the coalition was awarded $2 billion to create safer, healthier, more affordable homes, focusing on low-income and disadvantaged communities. Sign up for updates on Power Forward Communities and new lending vehicles, low-interest financial products, and technical assistance programs to support your community’s green energy transition.

The five CCIA awardees will establish financing hubs that provide funding and technical assistance to community lenders working in low-income and disadvantaged communities. The 60 recipients of the Solar for All awards – including 49 state-level awards, six awards to Tribes and five multistate awards – will create new or expand existing low-income solar programs.

GGRF project-level funding will likely be available starting in late summer. Learn more about the winning proposals for each program on the EPA website.

We look forward to working with our partners to ensure the programs laid out here create a more sustainable, more affordable, and climate resilient future. Learn more about our work across green building, climate risk reduction and equitable decarbonization, and stay tuned for updates as more federal program funding becomes available.