In 2021, as the nation was still grappling with the effects of the Covid-19 pandemic, millions of American renters were facing another challenge – increasingly unaffordable housing. According to our latest analysis of data from the U.S. Census Bureau’s American Community Survey (ACS), the number and share of renters that year reporting rental housing cost burdens – spending more than 30% of their income on housing – rose across all subsets of renters by race/ethnicity and incomes, with the largest increases observed among renters of color and those with extremely low incomes.

These findings deepen our understanding of our prior reporting on 2021 ACS tabular data, which showed that the share of cost-burdened renters overall increased between 2019 and 2021, reversing a 10-year trend in improving rental affordability. Since then, the Census Bureau released ACS in microdata form, which allows for more customized analyses of renter cost burdens, including by race and income expressed as a share of area median incomes (AMI), which accounts for variations in economic conditions by location. We can use this data to obtain a fuller picture of the challenges that low-income renters of color in particular were facing as the nation sought to recover from the depths of the pandemic’s economic and housing impacts. Addressing these shifts and ensuring increased housing affordability and stability for low-income and renters of color should remain a priority for policy makers going forward.

Renter Affordability by Race and Ethnicity

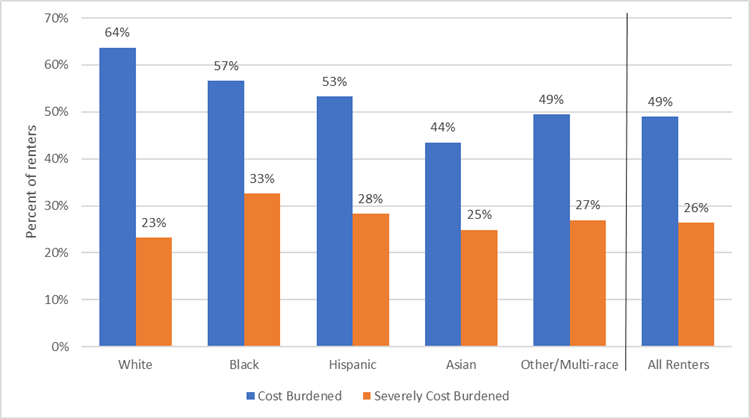

In 2021, while half of all renter households were cost burdened, that share was higher for Black and Hispanic renters, at 57% and 53%, respectively. Among white and Asian renters, meanwhile, 44-45% of households had rental cost burdens. Renters of color were also most likely to be “severely cost burdened”—that is, paying more than 50%of their income for housing – including nearly a third of all Black renters, as compared to 23% of white renters (see Figure 1).

Perhaps even more troubling than these static numbers is how they compare to the affordability conditions for renter households of color before the pandemic. For example, there was a noticeably larger increase in the share of Black renters who were cost-burdened relative to 2019, when 54% reported spending over 30% of income on housing and 29% reported spending more than half. Indeed, Black renters had the largest percentage point increase among all racial/ethnic groups in share of severely cost-burdened households, increasing by 3.3 percentage points (versus a 2.5 percentage point increase among renters overall).

Renter Affordability by Income as a Share of AMI

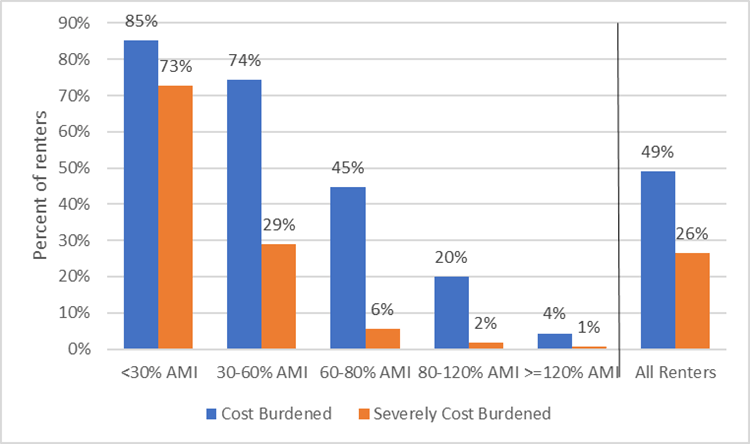

When considered by income, we see more dramatic variations in the share of renter households with cost burdens. This is not a surprise, of course: the national shortage of affordable rental housing and federal rental assistance that only subsidizes one in four eligible households means the majority of lower-income households spend a large share of their earnings on rent each month. Even renters with more moderate incomes, however, still face high-cost burdens, with one-fifth of renters who earn between 80% and 120% of AMI spending over 30% of their income on housing (see Figure 2).

Compared to pre-pandemic levels, the share of renters with cost burdens rose for all income groups, though those increases were greatest among those with incomes less than 30% of AMI. That share of severely cost burdened renters rose by 3.5 percentage points – adding onto an already very high percentage to begin with. Some of this growth can be explained by shifts in renters across the income spectrum; as incomes declined for renters during the pandemic, the number of those in the below-30% AMI category increased by nearly 500,000. As their rents likely did not also decline, many of these new lowest-income renters would have also been dealing with greater affordability challenges. The renters falling out of the higher income categories, meanwhile, would likely have been a mix of those with and without cost burdens before the pandemic, so their removal from those groups did not have as dramatic an effect on their cost burden shares.

Challenges for Low-Income Renters of Color

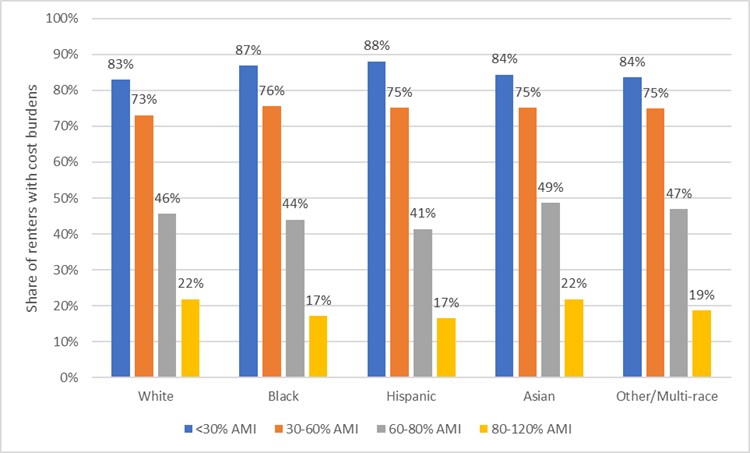

Combining the data by race/ethnicity and income, we see the dual impact on low-income BIPOC renters. While renters with incomes under 30% of AMI are the most likely to be cost burdened, those shares are around five percentage points greater for Black and Hispanic renters (87-88%) relative to white renters (83%). The difference is less dramatic among renters earning 30% - 60% of AMI, with Black and Hispanic renters only slightly more likely to be cost burdened (75-76%) as compared to white renters (73%). (See Figure 3)

The situation changes, however, among renters earning 60% - 80% of AMI; Asian renters in this income range are the most likely to be cost burdened, with 49% spending large shares of their income on housing, followed by white, multi-racial and other renters (46-47%). Indeed, Black (44%) and Hispanic (41%) renters in this income group are the least likely to be housing cost burdened. Likewise, among households earning 80% -120% of AMI, 22% of white renters were cost-burdened, which is 5 percentage points more than the share of Black and Hispanic renters (17%). Part of this shift is attributable to larger shares of white renters among these moderate-income groups, while the majority of Black and Hispanic renters earn less than 60% of AMI.

The concentration of housing affordability challenges among low-income renters of color should be cause for concern among federal policymakers, particularly as they negotiate FY24 appropriations and funding levels for crucial housing programs like HOME, CDBG-DR, and housing choice vouchers. Federal appropriators need to fully fund existing commitments to housing assistance, as well as expand resources to help the more than three-quarters of eligible low-income renters who do not receive assistance, to ensure the post-pandemic uptick in affordability challenges does not portend a longer-term trend.