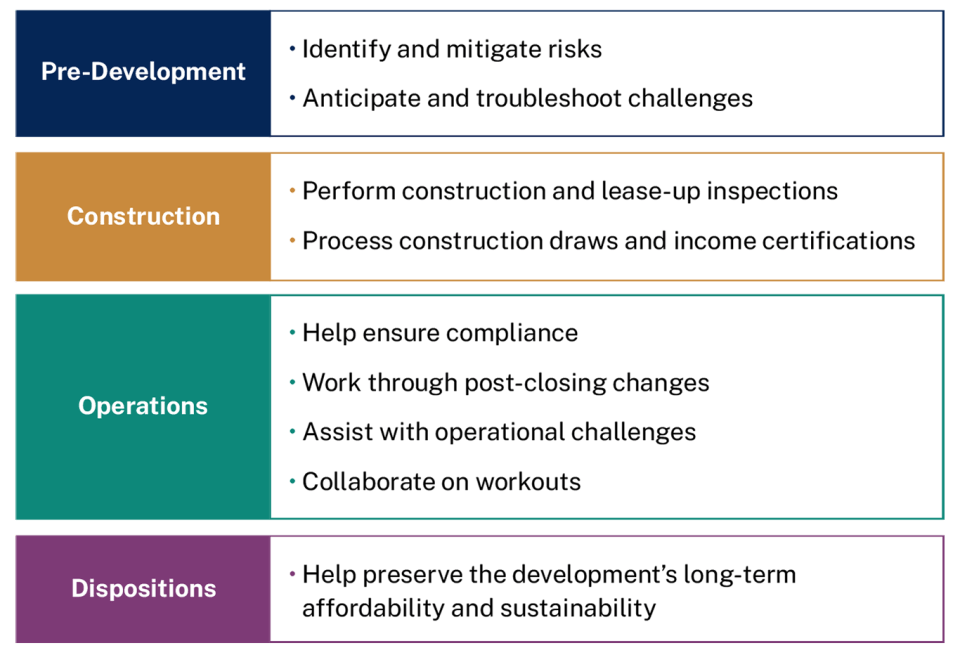

How Our Asset Management Team Helps Over the Lifecycle of Your Development

Property Reporting and Compliance

Information for Low-Income Housing Credit Project Owners/Managers

Information necessary for compliance with the reporting requirements of our operating partnerships is outlined below, as well as helpful information regarding the latest reporting, accounting, tax and compliance guidance for operating partnerships, required financial statement content and annual capital confirmations, as well as a listing of the operating partnerships where the requirement to review the draft audit and tax return is required.

Year-End Reporting

The general partner is responsible for ensuring that an annual audit is prepared and that tax returns are filed timely. Enterprise Community Asset Management reviews these documents, generally in draft form, to ensure that the reports meet the requirements of the partnership agreements, and that benefits delivered and activity are expected.

Enterprise provides a secure portal for the collection of year-end financial information, including:

- Audits

- Tax Returns

- Engagement Letters

- Component Auditor Letters

- Work papers, where required

All audits and tax returns are required to be submitted through a secure portal that requires a “key." This key allows our partners and their certified public accountant (CPA) firms to establish a unique user ID and password. All CPA firms and sponsors should have this key. Download the Quick Reference Card.

Other helpful tools and information:

- 2024 Financial Statement Preparation Guide

- 2024 Tax Return Preparation Guide

- 2024 (Fiscal Year End) Audit and Tax Return Requirements

- 2024 Audit and Tax Return Requirements

Quarterly Reporting

Enterprise has engaged a third-party data management company, MRI, to collect occupancy data and financial information from our partners on a quarterly basis. Each quarter, the operating partnerships submit a reporting package via email to MRI, generally within 15 days of quarter end, as follows:

- First Quarter: due April 15

- Second Quarter: due July 15

- Third Quarter: due October 15

In addition, quarter-end occupancy figures are entered into the MRI website, typically by the site manager, within five days of the end of the quarter. Use these instructions to access the MRI system to obtain a user login and password for entering occupancy data.

Enterprise reviews this information to understand and monitor property operations and to report activity to investors. Contact us if you have any questions or comments.

Insurance

Enterprise Community Asset Management, through our consultant, Traxler & Tong (T&T), closely monitors the insurance coverage of the operating partnerships. T&T has over 30 years of providing independent insurance risk management and consulting services. This includes:

- Maintaining current documentation for insurance after a project closes

- Monitoring critical renewal information through monthly exception reports

- Reviewing source documentation for compliance with the operating partnership agreement and fund documents

To support on-going changes that occur in the insurance industry, T&T utilizes their industry expertise as well as data from A.M. Best.

Post-Closing Changes

Enterprise monitors the operating partnerships and works with the general partners when changes occur after a deal closing. Enterprise generally needs to approve post-closing changes, and in certain instances, investor consent may also be required. The following list has some examples of post-closing changes that require Enterprise review:

- Refinancing and/or placement of subordinate debt (must pay or soft)

- Any change in loan terms or sources, including early pay-off

- Any new sources of funds (grants, subsidies, equity, etc.)

- Improvements not contemplated in original underwriting, including green improvements such as solar panels or power purchase agreements

- Improvements contemplated in original underwriting but without definitive funding source(s) that are not included in the cost cert, or contemplated improvements are being removed from the scope

- Any changes to common area space and/or units

- Property management firm changes or fee changes

- Changes in CPA firms

- Transfer/assumptions of a GP interest and/or changes related to guarantors

- Changes to reserve requirements and/or intended use of reserves

- Changes to set asides in any regulatory agreement

- Entering into any lease or use agreement (e.g., rooftop leases or any other commercial lease(s))

- Changes to insurance coverage, carriers or limits that deviate from operating agreement requirements

- Changes to bank accounts in which Enterprise is co-signatory

- Easements, right of way, right of use or partial land sale

- Changes to fees charged to a project that affect net operating income and cash waterfall

Reserves

The majority of the operating partnerships in the portfolio have both a replacement and an operating reserve. Enterprise monitors the reserve balances for compliance with LPA and other agreements. Enterprise is also frequently a co-signer on the accounts.

When the general partner requests withdrawals from either account, Enterprise will review their request, as well as appropriate supporting documentation for reasonableness. If the request relates to a withdrawal of operating reserves, Enterprise will also review the sufficiency of reserves by preparing and reviewing a projection of cash needs for the operating partnership.